SPRING ECONOMIC FORECAST | May 6-12, 2016

By Henry Dubroff

Staff Writer

1) Looking backward, does it seem right to you that the Fed began raising rates last December? What lies ahead for Fed funds and does it make any sense at all?

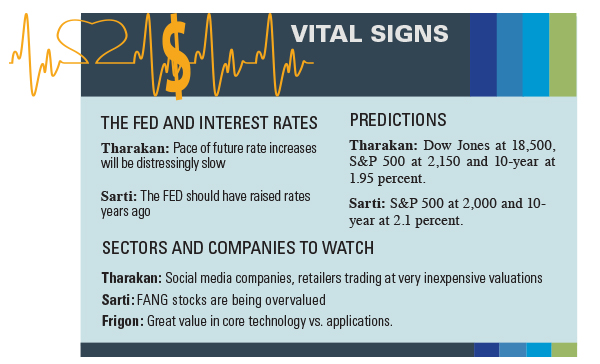

• Tharakan: The Fed needed to raise rates because zero interest rate policy was distorting the system. However, the pace of future rate increases will be distressingly slow. There are a number of reasons for this. First, money velocity has collapsed due to lack of confidence amongst investors and business executives. Overall loan growth in the first quarter of 2016 was roughly 3 percent by our calculations.

Second, the drop in velocity has led to timid inflation expectations. Pricing power in the overall economy is very low. From our bottom-up analysis, we believe nominal growth in U.S. retail spending was roughly 2 percent in the month of March. Such mediocre nominal growth rates allow the Fed to be patient as it normalizes rates. Finally, after a long period of quiescence, the credit cycle has turned furiously. Non-performing loans are up dramatically this year, primarily driven by weakness in the energy sector.

• Madlem: With the U.S. at or near full employment and inflation not that much below target, it makes no sense for the FOMC to be continuing extreme accommodation. The U.S. economy is far more resilient than many people and far too many policymakers give it credit for. Besides, at current low levels, interest rates are not a major factor. The Fed reaped no benefit cutting rates below 1 percent; there should be little or no downside to raising back to 1 percent, even higher near-term.

• Sarti: The more appropriate question is whether the Fed should have raised rates years ago. At the onset of the measures taken by the Fed in 2008, we were told that their “emergency” actions would be temporary.

However, here we sit more than seven years later and we are still hovering near 0 percent interest rates. While the economic recovery has been disappointing and macro concerns persist, we feel that a normalization of interest rates should have happened years ago. The Fed’s move to raise rates in December was simply an attempt to save face. Backpedaling has begun as fewer rate hikes are now expected and a fourth round of quantitative easing is being hinted at by some Fed governors in recent communications.

• Lowenstein: The Fed’s reaction function is truly confusing markets. They have become a prisoner to market temper tantrums on policy shifts and overly reactive to the immediate consequences whenever there is any stress on risk assets. This is a symptom of markets and economies becoming too dependent on central bank policy and there is risk of overreaching. The Fed changed their interest rate normalization course after seeing the impact on markets from just a 25 basis point hike in the Fed Funds rate in December. In her recent commentaries, Janet Yellen justified altering the path because of unexpected global market instability and growth risks.

Now divergent Central Bank policies, after years of globally synchronized easing policies, triggered a stronger U.S. dollar and uncovered latent risks hiding in plain sight. The dollar’s move resulted in significantly weaker commodity prices and widening credit spreads in high yield markets and in overly-indebted emerging markets that was simply too destabilizing for a global interconnected economy growing at close to stall speed. Global stability is now more important than U.S. inflation and unemployment at this juncture given the imbalances and structural problems built up this cycle. Exceedingly important, it seems the dollar is the new transmission mechanism for Fed policy, as the banking system didn’t unleash the wave of credit expansion expected to boost growth to its potential.

Loss of confidence and credibility at the Fed is now an emerging issue, from diminishing returns to its policy measures and the counterproductive effects now apparent. Looking under the hood, the Fed was also very concerned that the Chinese might unpeg their currency in reaction to the strengthening dollar and in turn cause a disorderly devaluation and adverse outcomes to risk assets across the globe. Foreign currency movements have been very extreme the last few years as countries try to devalue to gain exports market share in a low-growth world and trigger inflation to deflate unsustainable debt levels. HighMark’s view is that the Fed is in a holding pattern for now, even though we believe there is a fundamental justifimtion for two more rate hikes this year.

• Frigon: We believe the Fed has been behind the curve on interest rate increases and should be more aggressive in raising rates and getting monetary policy “normalized.”

The economy can handle higher interest rates and the extended “zero interest rate policy” has served to leave the environment of crisis in place far too long when there is no crisis any longer.

2) So far this year, it’s been sound and fury for equities but actually not much gain. Are there any sectors/companies that you see as being particularly overvalued or undervalued?

• Tharakan: We feel that areas where there is tremendous interest by investors and the media are overvalued. Examples include social media companies. Investors are blithely ignoring the single biggest expense for these companies – employee stock compensation. LinkedIn issued over $700 million in restricted stock last year, 25 percent of revenues. Google issued almost $7 billion in stock. Netflix does not generate any cash. Conversely, there are sectors that are unloved by investors because of fear. Host Hotels, the largest owner of hotels in the U.S., trades below replacement cost. Investors fear the effect of Airbnb on the hotel business model. Similarly, there are a number of brick & mortar retailers trading at very inexpensive valuations due to the fear of being “Amazoned.”

• Madlem: We see three potential scenarios playing out: 1) defensive/growth names continue to lead; 2) there is a change in leadership to cyclical/value names; or, 3) we get clobbered in a new credit crisis-driven equity bear market. The markets will probably rotate around all three over the foreseeable future before the emergence of a new long-term structural trend.

We are optimistically looking at potential growth leadership in alternative energy (hydrogen economy), cyber-security and artificial intelligence as well as financial tech focusing on the “sharing economy.”

• Sarti: We believe that the stock market in general is overvalued, which has been further exacerbated by declining earnings. Much of this overvaluation is being driven by the sexy FANG stocks (Facebook, Amazon, Netflix, Google) and other culprits that have captured the imagination of the investing public.

Many of these highfliers are trading at astronomically high valuations that are reminiscent of late 1990s Internet boom valuations. In the public markets, the dislocation that occurred in January and February did uncover some interesting opportunities; namely, energy stocks and certain areas of the fixed income market. However, in this policy-driven environment, we prefer to focus on niche assets that we believe are less influenced by extreme monetary actions.

• Lowenstein: Markets sold off hard to begin the year centered on fears of a global recession that hasn’t materialized quite yet, although growth is clearly challenging, risks building, complacency and overvaluation a concern and we are likely late in cycle. Consequently, risk-off positioning outperformed with growth, safety, yield and defensive plays leading the market while higher beta risk assets really struggled. However, we saw a dramatic change in positioning as the quarter unfolded when hyper- accommodative central banks and a weaker dollar propelled economically sensitive cyclical plays, value and commodities to new leadership status.

Our portfolio positioning generally attempts to uncover favorable unrecognized industry trends and opportunities which often are overlooked and potentially mispriced by the market. From a sector perspective, we have long favored the most cyclical and economically sensitive areas of the market because we thought, somewhat counterintuitively, the economy would actually benefit from normalizing to higher rates and relative valuations had widened to really attractive levels. Areas of the market that would benefit most from this shift would be areas like industrials, financial and technology as opposed to defensive yield plays and other bond proxies of the market that were bid up to unsustainable levels as people were simply hunting for yield at any price.

Equally important, financials have underperformed most of this cycle amid heightened regulatory scrutiny and lawsuits, anemic loan demand, requirements to build capital, and re-organizing their asset portfolios for a new business model post crises. We think most of the overhangs are now in the rear view mirror, and this group is at least poised to earn its cost of capital which should warrant a premium to book value verses a discount.

• Frigon: We see great value in core technology vs. applications (think social networking) in the current environment. In recent years, applications have become overvalued whereas telecom network infrastructure, analog processor and network processors, virtualization software and services, and medical technology have, for the most part, been relatively undervalued.

3) The presidential election has made a lot of noise but so far most investors seem pretty blasé about the election and its impact on the economy. Your thoughts?

• Frigon: There is the potential for some much-needed policy changes, depending on how the election goes. It is our view that if we end up with an administration that favors the “status quo” we will continue in a below-average economic growth environment.

• Lowenstein: A weak economic recovery this cycle of 2 percent, verses normal of 4 percent, has spawned populous candidate movements here in the U.S. election cycle. The electorate is upset because of stagnant wage growth, lack of robust job opportunities, limited upward mobility and increasing income inequality despite much hope that increased fiscal stimulus and economic redistribution initiatives over the last eight years would solve matters.

In all likelihood, Hilary Clinton will be nominated, at least according to the most recent polls, and she seems to be the most establishment-type candidate and least polarizing figure of the group ,which probably will be a relief to markets. Of course, there is a risk she is indicted on corruption and/or obstruction of justice charges from the FBI submitting a complaint to the DOJ because of her email server controversy.

Bernie Sanders and Donald Trump present more market risk because both have more extreme policy positions that would upset the status quo. However, even if one of these two were elected, there is still a low chance such extreme policies would be enacted because Congress will simply refuse to go along with such radical measures. In all likelihood all candidates will be moving toward the middle over time.

• Sarti: We believe that the economy is the most important issue we face today, with extreme monetary policies and unsustainable debt burdens posing significant threats to future generations. However, the American public generally does not understand the enormity of the fiscal imbalances that we are facing as a country.

The Federal Reserve’s manipulation of interest rates to historically low levels has instilled this apathy amongst investors. If the invisible hand of the markets was allowed to serve its function, interest rates would be higher. Higher rates would serve as an important signal for investors that all is not well with the world and they would put pressure on policymakers to implement the necessary reforms to right our economic ship.

• Madlem: Gridlock is the natural state of Washington, DC. We seriously doubt that any of the candidates would accomplish much in the near-term. And if they do, the 2018 midterm elections will swing the pendulum back. Moreover, the crushing realities of entitlements, which no one wants to address now, will soon undermine most grand schemes. In particular, we heavily discount all the bluster on both sides about trade and protectionism. The simple fact is that U.S. winners outnumber losers in free trade, by quite a considerable margin. That is why trade barriers have been diminishing for over half a century.

• Tharakan: Both sets of candidates are capitalizing on the angst of the middle class and the lack of dynamism in the economy. Real household income has barely budged in the last decade and a vast majority of the population fear being left behind. The candidates seem to have identified the issues at the top of voters’ minds but offer few constructive solutions.

4) Looking out to the longer term, what are one or two major developments that could change your view of equities — up or down?

• Frigon: To go along with my answer to the previous question, if there were a true “pro-growth” agenda pursued in Washington, D.C. (something akin to 1980s-style reforms), we would expect a significant revaluation of equities to the upside.

• Lowenstein: Surprisingly, markets have been quite resilient and upward bound in the face of the latest geopolitical events and anemic world growth. Until recently, macro event tail risk had been the dominant factor over the last few years in market conditions leading to violent market swings based on the latest news and events.

Markets are getting somewhat macro fatigued now and are not being as reactive as in the past as false alarms occurred which didn’t derail the rally. Specific areas of concern we are watching closely for signs of stress and contagion are widening high yield bond spreads, deteriorating Chinese and emerging market conditions, and the global burden of unproductive debt levels slowing growth and causing disinflationary forces. According to McKinsey, we have added $70 trillion of new debt to the global economy since the peak of the last crises, effectively using debt to solve a debt problem.

Over the last two decades, China and emerging markets were the engines of growth but now we wonder if they are operating with a broken growth model because global trade is in secular decade, commodity prices are re-basing for a new normal, and they carry heavy debt burdens. They need to rebalance and restructure their economies to deal with the structural imbalances which were created in the boom years. This will be difficult in the face of a stronger dollar and weakening global growth.

A potential black swan event such as a disorderly Chinese devaluation of 10 percent to 20 percent. Responding would highly destabilize markets and risk assets in our opinion. This could unleash deflationary forces and make high debt levels very problematic.

• Sarti: We are now in a confidence game. As long as global investors have continued confidence that global central banks can control the markets, asset prices may remain elevated and potentially move higher from here.

However, if confidence in these policies wanes or even breaks, we feel the markets will face significant challenges. We keep an eye on large and sudden moves in the currency and interest-rate markets as such moves signal that the central banks may be losing their grip on these key markets.

• Madlem: One can talk about fundamentals, and clearly, some of the macroeconomic data for stocks have recently turned more bullish; for example, the China stimulus, a more dovish Fed, stabilizing oil prices, rising commodity prices, and narrowing high-yield spreads. But the most critical market catalyst remains the Central Banks, followed by corporate CEOs and chief financial officers. The former supply liquidity while the latter use it for mergers and acquisitions or share buyback programs that have served as the primary propellant for markets.

The impending European Central Bank’s purchase of corporate bonds could be momentous for U.S. stock and bond investors.

• Tharakan: A trade war between the U.S. and China would result in a significant negative shock to U.S. markets. A continued deterioration of credit quality in the banking system can have negative consequences and bears monitoring.

Markets may plausibly get a boost if the new president and Congress can come to terms on a sorely-needed infrastructure spending plan. President Bush added $5 trillion to the federal debt and President Obama has added another $9 trillion. Markets may get another booster shot if Congress and the new administration can compromise on a plan to reduce the deficit and pay down the debt.

Extra Credit: Finally, anybody want to predict stock market valuations and 10-year Treasury yields at the end of the year?

• Tharakan: Dow Jones at 18,500, S&P 500 at 2,150 and 10-year at 1.95 percent.

• Sarti: S&P 500 at 2,000 and 10-year at 2.1 percent.

• Frigon: We don’t make guesses on the stock market, just buy great companies. We do, however, think that interest rates will be higher by year end.