Ceres files for $20M offering

IN THIS ARTICLE

- Agribusiness Topic

- Staff Report Author

By Staff Report Friday, January 24th, 2014

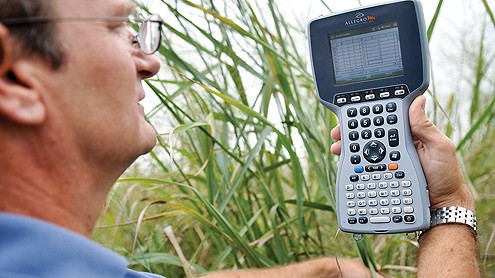

A Ceres switchgrass researcher collects field data in a breeding nursery. (Ceres media photo)

Energy crop company Ceres said Friday that it plans to raise up to $20 million in new capital by selling additional shares of common stock.

In regulatory filings, the Thousand Oaks-based firm said it would like to use the proceeds from the public offering to expand its Brazilian operations, participate in collaborations and break into new markets.

“We use a combination of advanced plant breeding and biotechnology to develop seed products that we believe address the limitations of first-generation bioenergy feedstocks, such as corn and sugarcane, increase crop productivity, reduce crop inputs and improve cultivation on marginal lands,” the company said in a Jan. 24 filing with the Securities and Exchange Commission.

Ceres said it sees its greatest commercial opportunity in the Brazilian ethanol market, which currently uses sugarcane as the predominant feedstock for the fuel. The company said sugarcane can only be used in mill operation about 200 days per year. Ceres, meanwhile, has a hybrid sorghum product. “We believe that sorghum has a number of favorable attributes as a biopower feedstock and can be utilized as a supplementary source of biomass, especially during the offseason or periods of sugarcane bagasse shortages,” the company said in filings.

With the exception of 2003, 2005 and 2006, the company has not generated annual profits since its inception. In 2011, the company netted a $36.3 million loss on $6.6 million in revenue, followed by a $29.4 million loss on $5.3 million in revenue in 2012. Last year, its loss was $32.5 million on $5.2 million in revenue.

Most of Ceres’ revenue thus far has been from government grants and collaborations, with very little coming from seed sales. In its filing, the company said it had an accumulated deficit of $282.8 million as of Nov. 30, 2013. “We expect to incur additional losses for at least the next several years as we continue to invest in our research and development programs, develop new products and move forward with our commercialization activities,” the firm said. “The extent of our future net losses will depend, in part, on our product sales growth and revenue from collaborations and government grants, and on the level of our operating expenses.”

Ceres went public in February 2012 with a $65 million IPO.

Aegis Capital Corp out of New York is the underwriter for the latest stock offering. The company’s shares slipped 3.4 percent to $1.43 in after-hours trading on Friday.

[wikichart align=”center” ticker=”CERE” showannotations=”true” livequote=”true” startdate=”24-07-2013″ enddate=”24-01-2014″ width=”580″ height=”350″]Related Articles

Friday, October 21st, 2022

Friday, October 21st, 2022

Dubroff: Winds off the SLO coast hold part of the key to zero-carbon future

Friday, September 2nd, 2022

Friday, September 2nd, 2022