Central Coast has time to adjust to Diablo Canyon closure

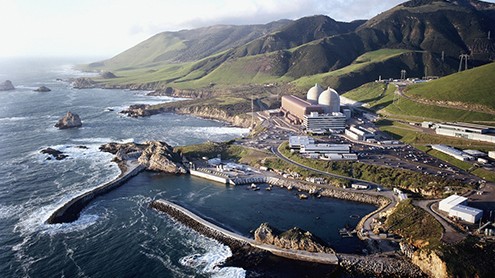

The Diablo Canyon Power Plant sits on prime coastal property near Avila Beach.

The closure of the Diablo Canyon Power Plant will hurt the San Luis Obispo County economy but the region will have time to adjust as the plant cycles down, Robert Kleinhenz of Beacon Economics said.

Pacific Gas and Electric announced plans in June to close its power plant by 2025, leaving the area without one of its most prominent employers and source of property tax revenue and high-paying jobs.

“This is an instance that really represents what we hear in the abstract that tomorrow’s jobs aren’t going to be what today’s are like,” Kleinhenz said at the Central Coast Economic Forecast at the Alex Madonna Expo Center on Nov. 4. “There will be a huge adjustment period. There are a lot of different aspects of the local economy that will be affected by this but there is some time to plan accordingly.”

Despite the economic ripple effects of the looming plant closure, economists expect the regional economy to continue to grow, albeit slowly.

Diablo Canyon offers about 1,500 well-paying jobs with an average salary of more than $100,000. Its payroll accounts for 1.5-2 percent of the total payroll of the entire county, which is equivalent to the agricultural sectors’ total payroll, Kleinhenz said. The facility provides more than 9 percent of the energy that fuels the entire state.

While public schools and the county will miss out on property tax revenues when it closes, it will take several decades and plenty of man hours to decommission over several decades, he said.

“This circumstance gives us an opportunity to think more broadly about the different types of things that may affect our major industries and how we as a region can position ourselves going forward,” Kleinhenz said.

By most measures, prospects for the SLO County economy are good, the forecast concluded.

Business activity, employment and home prices have continued to grow over the last five years — total wage and salary (nonfarm) employment have hit all-time highs in four successive years. Tourism, agriculture, and leisure and hospitality will continue to drive economic growth.

“Tourism has a great potential for growth here in SLO for many years if not decades to come,” Kleinhenz said.

The housing market has continued to experience price appreciation despite volatility of sales activity, yet it has not hit pre-recession levels. Home construction is hampered by a lack of financing, sheepish developers and a number of anti-development policies aimed at addressing the countywide water shortage, the report found.

While interest rates are low, credit standards are high, which makes it difficult for first-time homebuyers to secure capital, Kleinhenz said.

“A lot of existing homeowners haven’t recovered their equity lost in the economic downturn,” he said.

All these factors contribute to a housing shortage and upward pressure on prices, which exacerbates the affordability problem. Only 27 percent of SLO County residents can afford the median home, compared to 20 percent in Santa Barbara County and 29 percent in Ventura County.

“Home prices are through the roof,” said Chris Thornberg of Beacon Economics. “It’s a supply issue. Single-family construction is almost nonexistent.”

California has terrible zoning laws, it doesn’t tax properties effectively and it empowers NIMBYs to fight tooth and nail against any kind of development, he said.

“It is not an affordable housing crisis, it is a housing crisis,” Thornberg said. “It’s not just low-income who are getting squeezed. Everyone is getting squeezed.”

Even though the upcoming presidential election could bear significant long-term consequences, it won’t impact much in the short-term, he said.

Thornberg does not expect a recession in the next two years. Labor markets are strong, real incomes are rising, the housing market is still recovering, inflation is slow and commodities are cheap, he said.

“GDP is growing slower than we like, but it’s growing,” Thornberg said. “The U.S. represents 5 percent of the world’s population and 20 percent of the world’s consumption. We are the biggest groups of spoiled brats on the planet. Stop whining.”

• Contact Alex Kacik at [email protected].