Regulatory agencies terminate Heritage Oaks Bancorp consent order

IN THIS ARTICLE

- Banking & Finance Topic

- Staff Report Author

By Staff Report Tuesday, November 29th, 2016

Heritage Oaks Bankcorp said Nov. 29 that state and federal regulatory agencies have terminated a consent order related to the Bank Secrecy Act and anti-money laundering programs at its Heritage Oaks Bank subsidiary.

The Paso Robles-based bank is the largest in the region with $2 billion in assets. Heritage Oaks said the Federal Deposit Insurance Corp. and the California Department of Business Oversight had both signed off on improvements to the bank’s compliance programs.

“We have enhanced our technology processes, training and personnel to improve our BSA program and we are pleased that we have satisfied the legal and regulatory requirements of the order,” said President and CEO Simone Lagomarsino in a statement.

News of the regulatory order termination came after the close of trading with Heritage Oaks Bancorp stock, traded on Nasdaq, ending the day at $10.13 cents, up 2 cents. Heritage Oaks shares have risen 21 percent during the past 52 weeks, according to Yahoo Finance. Financial stocks have been bolstered by the prospect of rising interest rates and a stronger economy.

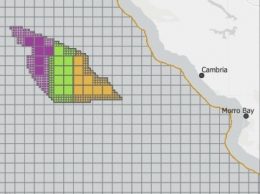

The bank has two branches each in Paso Robles and San Luis Obispo, branches in Atascadero, Templeton, Cambria, Morro Bay, Arroyo Grande, Santa Maria, Goleta and Santa Barbara and a loan production office in Oxnard.